In the ever-evolving landscape of the UK tech investment scene, understanding Who Are The Most Active Seed Investors In Tech? is crucial for aspiring entrepreneurs. Seed funding serves as the lifeblood for startups, enabling them to transform innovative ideas into viable businesses. These early-stage investments are vital in the technology sector, where the risks associated with new ventures often deter traditional funding sources.

Seed investors are not just financiers; they play an essential role in nurturing the next generation of tech talent and innovation. With their financial backing, startups can take significant strides forward, ultimately contributing to the robustness of the overall technology ecosystem. As we delve deeper into this world, we will explore the most active seed investors and how their contributions lead to successful outcomes for budding companies.

The Importance of Seed Funding in the Tech Sector

Seed funding stands as a cornerstone for startups within the technology sector. The importance of seed capital cannot be overstated, as it provides essential financial support for startups during their formative stages. This support enables young enterprises to develop their products, establish market entry, and cover operational costs.

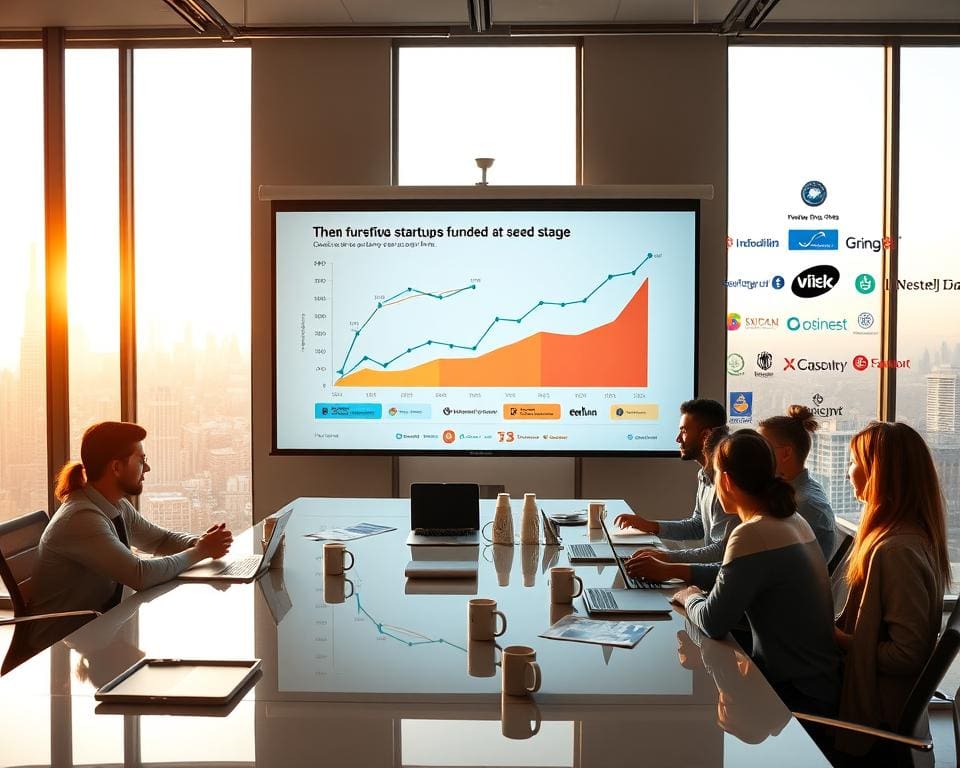

Statistics indicate a strong correlation between seed funding and technology sector growth, showcasing that startups with substantial seed investments tend to achieve higher growth rates. Investors play a pivotal role, as their initial backing fosters innovation and creates a robust foundation for future success.

Stories of successful tech ventures illustrate the transformative power of financial backing during these early stages. Entrepreneurs who secure seed investments often find themselves better equipped to navigate challenges, attract further investment, and ultimately flourish within an increasingly competitive landscape.

Who Are The Most Active Seed Investors In Tech?

Seed investors play a crucial part in the tech funding ecosystem, serving as the first financiers for emerging companies. Their contributions go beyond monetary support, as they often provide invaluable mentorship and facilitate connections within the industry. This multifaceted role of seed investors significantly enhances the chances of startup success by guiding fledgling entrepreneurs through their initial challenges.

Defining Seed Investors and Their Role

Active seed investors are individuals or firms that invest in early-stage startups. They assume substantial risk by pumping in initial capital, which often dictates the direction and pace of a startup’s growth. These investors are integral to establishing the foundational elements of a business, as they frequently offer expert advice, strategic direction, and introductions to potential partners and customers. This network of support can be crucial for startups navigating the complexities of the tech landscape.

The Impact of Seed Funding on Startup Success

The infusion of seed funding can dramatically alter a startup’s trajectory. Research shows that companies with early backing from seed investors tend to progress faster in product development and market entry. A notable example is the journey of organisations like Airbnb and Uber, which leveraged their initial seed capital to refine their offerings and capture market share. The impact of seed funding is not limited to scaling operations; it also influences company valuation and attracts further investment from venture capitalists, creating a ripple effect in the tech funding ecosystem.

Top Seed Investors in Technology

The landscape of technology investment is vibrant, with numerous players making significant contributions to the industry’s growth. The top seed investors in technology are instrumental in shaping the future, as they identify and nurture innovations that can disrupt markets. Understanding their investment strategies provides valuable insight for entrepreneurs seeking to attract venture capital funding.

Highlighting Industry Leaders

Among the leading tech seed investors, firms like Accel Partners and Sequoia Capital stand out due to their profound understanding of emerging technologies. They have a track record of backing companies that become market leaders. Their portfolio showcases a variety of successful startups across multiple sectors, from artificial intelligence to blockchain.

Investment Strategies of Leading Investors

Investment strategies employed by these industry leaders vary yet reveal common themes. Many focus on specific sectors where they hold expertise. Geographic preferences also play a role, with some investors favouring startup ecosystems in the United States and others concentrating on UK-based ventures. Identifying potential breakthrough technologies is essential, as these investors analyse market trends and keep an eye on consumer behaviours.

Understanding how these investors assess risk and potential return can empower aspiring entrepreneurs. By aligning with the interests of leading tech seed investors, startups can effectively position themselves to secure essential funding.

Prominent Seed Investors in Tech: A Closer Look

The tech landscape in the UK thrives largely due to the contributions of prominent seed investors. These individuals and firms not only provide crucial financial backing but also offer invaluable mentorship and industry insights to emerging startups. Their roles extend well beyond mere investors; they are often revered as tech industry influencers who shape the future of innovation.

Examining the profiles of notable seed investors reveals a tapestry of success stories. Investors such as Seedcamp and Accel have carved out remarkable niches, frequently backing startups that exhibit high growth potential. Their portfolio diversity spans various sectors, including fintech, health tech, and artificial intelligence, spotlighting their adaptability and strategic vision.

Notable achievements among these investors include the early funding rounds of successful enterprises like Monzo and TransferWise. Such investments highlight their keen eye for identifying groundbreaking ideas and trailblazing entrepreneurs. Through a combination of wisdom and resources, these prominent seed investors continue to steer the tech ecosystem towards exciting frontiers.

Best Tech Seed Funding Firms in the UK

Identifying the best tech seed funding firms in the UK requires a nuanced understanding of multiple factors that contribute to a firm’s reputation and effectiveness. The UK funding landscape is vibrant, populated with firms that offer not just capital but mentorship and strategic guidance. Startups should consider firms that demonstrate a proven track record of successful investments alongside robust support for their portfolio companies.

Criteria for Selecting the Best Firms

To ascertain the best tech seed funding firms, several criteria must be taken into account:

- The historical success rate of their portfolio companies

- Industry reputation and the credibility of partners and advisors

- Quality and reach of their network, including access to potential customers and markets

- Engagement with startup incubators to foster innovation and development

Success Stories from Top Funding Firms

Several firms have emerged as leaders within the UK funding landscape, showcasing what can be achieved through their investments. For instance, Seedcamp has played an instrumental role in the growth of numerous startups, providing not only initial funding but also invaluable guidance. Their approach focuses on nurturing young startups, leading to a remarkable portfolio filled with successful investments.

Furthermore, Voices and Gokind, notable seed funding firms, have each propelled their investments towards notable market successes. Such instances illustrate the profound impact that these firms have on the landscape of tech entrepreneurship in the UK. Through strategic alignment with the right startup incubators, firms can catalyse ideas into thriving businesses, inspiring future generations of innovators.

Trends in Tech Industry Seed Funding

The landscape of seed funding in the technology industry evolves continuously, reflecting broader societal changes and market demands. Currently, one of the most significant trends in seed funding is the increasing emphasis on sustainable technology investments. Startups focusing on eco-friendly solutions attract investor interest, signalling a shift in priorities toward environmentally responsible innovation.

Equity crowdfunding has gained traction as an alternative funding avenue. This model allows a broader range of investors to participate in early-stage ventures, democratizing access to investment opportunities. Technology industry funding patterns now incorporate platforms that enable smaller investors to support startups, thereby creating a more engaged community around emerging technologies.

Shifts in investor expectations also play a crucial role in shaping the current funding landscape. Investors seek startups that demonstrate not only profitability but also social impact. This evolution prompts entrepreneurs to adapt their strategies by aligning their business models with investor values.

Geopolitical factors and rapid technological advancements further fuel changes in funding dynamics. In an interconnected world, market fluctuations can influence the appetite for risk among investors. Startups must remain agile, ready to pivot in response to these external pressures while identifying new investment opportunities.

Top Investors in Tech Startups: Their Contributions

In the dynamic realm of tech startups, several investors have emerged as pivotal figures, significantly affecting the landscape. Their insights and capital fuel innovations, making them top investors in tech startups. Each investment decision aligns with a vision that extends beyond mere financial returns, focusing on elevating the contributions to tech economy.

Investors Who Are Making Waves in the Scene

Pioneering investors like Sequoia Capital and Accel Partners consistently demonstrate a keen understanding of emerging technologies. Their approach to scouting high-potential startups involves a combination of rigorous analysis and instinctive intuition. These investors often back ventures that challenge the status quo, demonstrating how calculated risks can lead to groundbreaking advancements.

- Sequoia Capital’s commitment to nurturing its portfolio supports a new generation of innovators.

- Accel Partners’ early investments in now-mature companies showcase their foresight in identifying trends.

The Future of Tech Investments

The anticipated future investment trends suggest a shift towards sustainable technologies and AI-driven solutions. Investors are increasingly focused on backing companies that not only promise strong financial returns but also contribute positively to society. As these top investors in tech startups adapt to evolving market demands, their influence will undoubtedly continue to shape the tech economy for years to come.

Navigating the Seed Funding Landscape for Tech Companies

Navigating seed funding can seem daunting for many tech entrepreneurs, but with the right strategies, it can lead to tremendous growth opportunities. Tech companies must first prepare thoroughly for investment pitches, presenting not just innovative ideas but also a clear business model and market strategy. Investors look for startups that show promise and potential, thus founders should focus on articulating their vision and the value they bring to the table.

Building strong relationships with potential investors is crucial in the realm of tech companies funding strategies. Engaging with investors before formal pitches can create a rapport and improve your chances of securing funds. Attend networking events, leverage social media, and seek mentorship from those with experience in the seed funding process. By actively participating in the investment landscape navigation, founders can gain invaluable insights and advice.

Understanding the nuances of funding agreements is equally vital. Entrepreneurs must align their objectives with investor expectations to foster a productive partnership. It’s not just about securing finances; it’s about building a supportive environment that nurtures growth. By leveraging the insights gained from previous discussions and adapting to the changing landscape of seed funding, tech startups can increase their chances of achieving successful funding outcomes in the future.